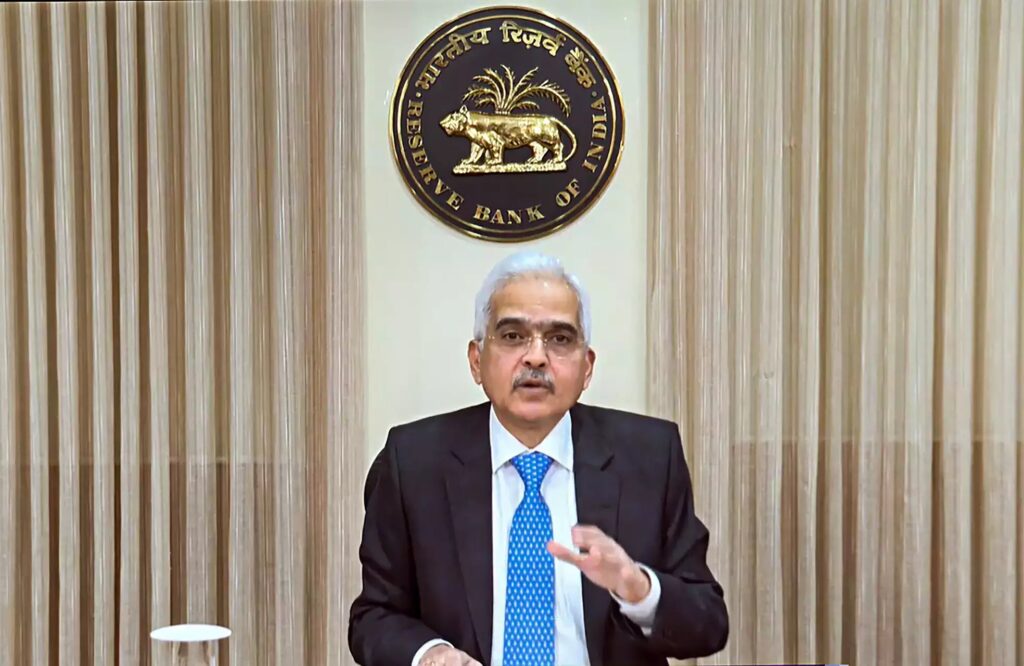

The MPC, directed by RBI Governor Shaktikanta Das, has continuously maintained the repo rate to keep prices stable and retail inflation low.

The Reserve Bank of India, as predicted, kept the repo rate constant for the seventh time in a row on Friday.

The decision was made during the RBI’s Monetary Policy Committee, aka MPC, meeting on April 3. Recently, RBI Governor Shaktikanta Das held a news conference to announce the MPC meeting decisions. For the seventh time in a row, the repo rate remains unchanged. Also, it has been reported that the RBI is continuing to remove accommodation.

Five of the six members who attended the MPC meeting, including Governor Shaktikanta Das, reportedly supported maintaining the repo rate steady. The decision was passed by a vote of 5:1. Well, The 6.5 percent interest rate will stay the same as last year.

Predicted decision

Several financial analysts and rating agencies expected the RBI to leave the repo rate steady this time as well.

Discussion on the economic situation

In addition to announcing the MPC’s decision on the repo rate, reverse repo rate, and other policy rates, the committee meeting examined the current domestic and global economic conditions. India’s economy climbed by 8.4% in the fourth quarter of 2023. It is the most rapidly expanding of the main economies. Retail prices increased at a faster-than-expected rate of 5.09 percent in February, owing to increasing food prices. The desired result is higher than the RBI’s target of 4%.

In February, inflation fell to an average of 4.5% in 2024-25. One of the six Monetary Policy Committee members supported the rate cut. However, the price has not changed. India’s inflation rate is over the central bank’s target. Core inflation stays around 4%. It is said that this will allow the central bank to loosen its policies.

The Reserve Bank of India’s Monetary Policy Committee has agreed to retain the repo rate at its current level to keep retail inflation under 4% and maintain price stability.

Tune in LIVE▶️The RBI's monetary policy committee has voted to keep interest rates unchanged at 6.5%. The RBI also decided to maintain its withdrawal of accommodation stance.#rbi #rbimonetarypolicy #shaktikantadas #reporate #interestrates

— CNBC-TV18 (@CNBCTV18News) April 5, 2024

📺👇https://t.co/UD8vA2gTkF

There is good news for homebuyers

This is excellent news for house purchasers because the repo rate stays steady. Because the homebuyer’s monthly installments remain unchanged. House prices have risen in numerous cities since last year. Now that the repo rate has not increased, interest rates on house loans will fall, increasing the opportunity to buy a property at a reasonable price.